GAM Investment - Thriving Amid Stagnation

Stagnation is often touted as the metaphorical death knell for an economy. Julian Howard, head of multi asset solutions at GAM, suggests that there are ways to avoid the pitfalls of a slowing economy.

In the fields of economics and finance, the concept of secular stagnation is hardly new. It was first suggested by US economist Alvin Hansen in 1938 as a way to describe America’s slow recovery following the Great Depression. Economists Paul Krugman and Larry Summers then resurrected it after the global financial crisis of 2008. Unlike a technical recession, there is no set definition of secular stagnation, but most analysts broadly agree it implies several years of economic growth lagging below the trend rates established in previous decades. Today, the world economy remains in a low growth torpor. The US is forecast to grow by just 2.3% in 2019, according to economists surveyed by Bloomberg. This is in stark contrast to 1990s growth rates, which frequently hit 4% during the so-called ‘Clinton Boom’. Other advanced economies, such as Japan, the UK and the eurozone, are suffering below-trend growth at even lower rates. For many long term investors, this is fundamentally ‘bad news’, since equity market performance has traditionally relied on economic growth to drive corporate earnings. As such, we feel that stagnation is one of the most pressing investment issues today. Here, we will attempt to understand the causes of low growth, determine whether policy response can do anything about it and then explore how to invest for it.

In our view, the advanced economies’ stagnation confusingly derives from a combination of both too little and too much demand. Too little, in the sense that populations are rapidly ageing, resulting in fewer people working and consuming. According to the UK’s Office of National Statistics, the probability of a 65 year old reaching 80 years of age is now a very high 67% for men and 76% for women. While there is much to celebrate in this fact, it is also dampening aggregate demand in the economy. The other driver of stagnation is an excess of demand, this time for investment opportunities. Exporting and oil producing economies around the world are generating excess pools of capital in need of a home. In many cases, this money finds its way into the government bond markets, with the IMF estimating that Taiwan’s life insurers alone own 18% of all dollar debt issue by non-American banks. These trends have the effect of pushing down yields and interest rates. At the corporate level too, many large firms are hoarding revenues gained from years of globalisation into safe assets, rather than investing them into higher-growth opportunities. This unimaginative use of capital swiftly becomes self-fulfilling, as companies will be reluctant to commit to investing into a low growth world, thus dampening growth further.

Compounding the problem is low productivity, or output per worker, blamed by many on the lack of innovation of the last 20 years. Paypal co-founder Peter Thiel famously complained, “We wanted flying cars, instead we got 140 characters,” a reference to the incremental rather than revolutionary nature of recent technological advancement. Finally, the trade war between the US, China and now Europe has hit export volumes and forced the IMF to lower its global growth forecast to 3% and 3.4% for 2019 and 2020, respectively.

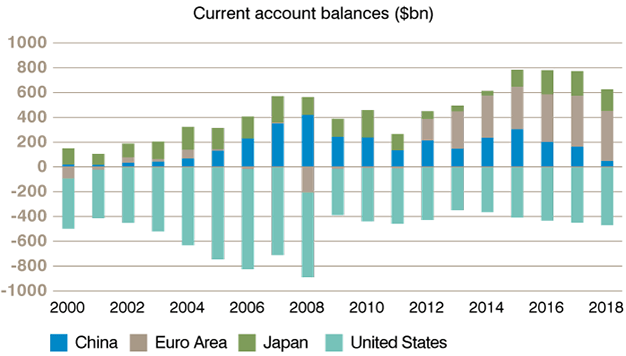

Chart 1: Plenty of savings, apparently nowhere to invest

Source: IMF World Economic Outlook

The international climate is ambiguous, but we believe that the UK is the primary economy at immediate risk of entering a recession. The world’s largest economies (US, China and Japan) have remained strong so far, in particular the powerhouse US. The UK, on the other hand, has the particular issue of the Brexit paralysis. Consumers have become more risk averse, while businesses are reluctant to invest heavily when surrounded by such ambiguity lack of clarity over the outcome.

Before extrapolating the current situation into the future and making investment decisions on the back of it, we must consider whether it could be reversed through policy response. Central banks have been doing all they can to avert stagnation through the steady loosening of monetary policy in recent years; however, the limits of this approach are now being reached. The eurozone, Denmark, Sweden and Japan all have negative deposit rates, but their savings rates have in fact increased over the same time span. This suggests that consumers are simply not responding to the temptation of cheap money, which raises questions around the kind of signals that negative interest rates are actually sending. Furthermore, public sentiment in economies such as Germany is turning against negative rates as ageing populations find that their savings deposits are being eroded. German tabloid Bild recently exclaimed, “Count Draghila is sucking our accounts dry!” in response to European Central Bank President Mario Draghi’s recent loosening of monetary policy to unprecedented extremes.

Fiscal policy, on the other hand, is often seen as a more viable alternative to kickstart stagnating economies. The post-war Eisenhower Interstate Highway system is estimated to have generated internal rates of return of around 600% for the US economy. Bearing this in mind, the case for infrastructure spending today is compelling – at least in theory. But political willingness to execute is quite another issue given high government indebtedness in economies such as the US, the UK and southern Europe, which ironically benefit the most from infrastructure spending. Germany has more fiscal room for manoeuvre thanks to its conservative spending stance and deep suspicion of state expansion since the war, but Finance Minister Scholz has appeared reluctant to act until an outright recession is in evidence. By this time, it would be too late.

Immigration could be another way to get around stagnation. Increasing the size of the productive workforce would be far more quickly achieved through immigration rather than encouraging higher fertility rates. But this looks like a distant prospect, too. In the US, a recent book by NY Times journalists Julie Davis and Michael Shear cited an alleged episode in which the US president wondered out loud whether a border wall could be fortified by an alligator-stocked moat. Even allowing for artistic licence, the anecdote chimes with the broader political narrative around immigration in the US today. Europe is hardly different, as evidenced by the rise of the far right in Germany, Italy and Spain. In the UK, Brexit is seen in some quarters as a partial response to the European Union’s (EU) cherished doctrine of free movement of people.

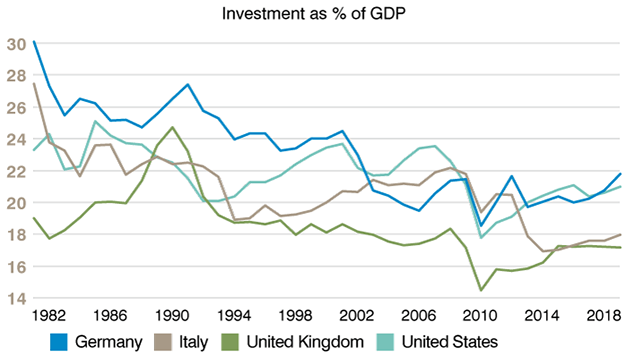

Chart 2: Plenty of savings, apparently nowhere to invest

Source: IMF World Economic Outlook

he above assessment might paint a bleak picture, but it serves a valuable purpose in confirming that stagnation is likely to persist unimpeded by policy response. Investors might invest accordingly. Perhaps surprisingly, we feel that stocks remain the asset class of choice. This is because interest rates (and therefore bond yields) are likely to remain near historic lows, making those equities that can offer at least some positive earnings growth appear relatively attractive. As at the end of November, the earnings yield on the S&P 500 equity index was just over 5%, far higher than the sub-2% offered by the 10-year US Treasury yield. Furthermore, stocks enjoying a secular narrative which can transcend the subdued GDP picture would likely be especially prized.

Technology is just one such example. Not only are technology stocks often able to create brand new markets, but their valuations are well-placed to benefit from low interest rates given the long ‘duration’ (sensitivity) of their future earnings streams. Another theme is environmental, social and governance (ESG) investing. As the millennial generation, with its uncompromising stance on equality and sustainability, starts to become a significant investing force, we believe this area will grow regardless of the wider economic backdrop. Emerging markets also offer a compelling antidote to the stagnation narrative. They boast generally younger populations and a growing middle class, in addition to being relatively under-owned by global investors and under-represented in global equity indices relative to their actual share of global output. Complementing this independent approach to equity investing, government bonds still have a role to play. According to Oxford Economics, global safe asset supply is expected to grow by USD 1.7 trillion annually, while demand from central banks (through quantitative easing), Asian economies and corporations is expected to be in the order of USD 2.2 trillion. Government bonds could therefore continue to rally even from these expensive levels, while yields conversely fall.

All that said, investors should understand that volatility across equities and bonds should feature heavily within the horizon of secular stagnation. As Winston Churchill once said, “All things are always on the move simultaneously”; extreme euphoria or deep gloom will surely characterise the long-run stagnation story. For example, at the time of writing, investors were hopeful of a ‘comprehensive phase one’ trade deal between the US and China. Although some professional investors may claim to successfully market time their way around such events, a cool-headed assessment of the long-run trends and how to position for them seems more likely to succeed. But even among those who accept the stagnation thesis, many will inevitably choose to invest defensively as they despondently survey the growth outlook for the coming years. We feel this is a lost opportunity, since we believe the best response to the stagnation challenge requires a certain boldness and belief that humanity will always find ways to innovate and improve itself. The prize for investors willing to take such an informed and differentiated approach could be surprisingly strong risk-adjusted returns.

More macroeconomics articles from GAM

Important Legal Information:

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator for the current or future development. Allocations and holdings are subject to change.