Matthews Asia - Wuhan Coronavirus

Matthews Asia CIO Robert Horrocks and Investment Strategist Andy Rothman offer their perspectives on the Coronavirus and its possible impact on China's governance and economy.

Robert Horrocks, PhD, Chief Investment Officer

Just as China's markets have emerged from U.S.-China trade war concerns, they have been hit with worries over a new virus, the Wuhan Coronavirus. While we do not underestimate the potential severity of the outbreak, and it is possible that the numbers of cases increase in the near term, we are encouraged by the response and transparency shown by the Chinese authorities.

There is also a precedent for what is going on. I was living in Shanghai during the SARS (severe acute respiratory syndrome) outbreak that was responsible for over 8,000 people contracting the virus and causing 774 deaths worldwide. The impact of SARS on China's GDP is hard to find. If you look for the impact on the stock markets, it was brief. Over the course of the outbreak, markets actually rose. So why do we pay so much attention to these things?

First, what is the likely duration? Well, it is probably likely to peak, in terms of cases, in March or April. As I understand it, the more virulent the virus, the quicker it burns out. That is why the comparatively less aggressive common influenza causes much more damage. In past years, the Center for Disease Control has estimated flu deaths in the U.S. alone at up to 80,000 in severe seasons.

Second, the cost to China's GDP? Some workers will be out sick days and some will succumb to the disease. However, as was the case with SARS, beyond the effect on a quarter or two of earnings for some businesses, the overall effects will be hard, if not impossible, to spot in the data.

Third, the impact on sentiment? Here it will be at its greatest. Why? Because U.S. newspapers always seem to overreact to any news out of China, good or bad. Also, the Chinese reaction itself can be extreme—add humans' natural fear of disease and the fact that China has a weaker health system than the U.S., and you can see why the local population reacts with great fear. You can see why the government takes logical but perhaps heavy-handed steps to control the outbreak. All of that plays to headlines and the impact on share prices is consequently exaggerated.

So, what to do? I can only say that my experience, when I lived through SARS first hand, tells me to eat well, stay active, and importantly, stay calm.

Andy Rothman, Investment Strategist

I'm not a doctor or a public health professional, but I do have the experience of living in Shanghai during the 2003 SARS and 2005 bird flu outbreaks, including being quarantined during the latter epidemic. That provided some first-hand exposure to the breathless media coverage of a novel disease, as well as the anxiety felt by many people who feared a mysterious pandemic.

I'm not in China today, but I am reading a lot, both from scientists and public health professionals, as well as from the general media. Based on that, I'd like to share some thoughts on the Wuhan coronavirus and its possible impact on China's governance and economy.

Context can help

In the early stages of a pandemic such as the Wuhan Coronavirus, it is difficult to predict how contagious infections can be, as well as how fatal. Initial genome sequencing of the Wuhan Coronavirus has already been conducted and found that it shares 79.5% of the SARS genome sequence. Some of you will remember the initial panic over the outbreak of SARS. In the end, between November 2002 and July 2003, a total of 8,098 people in 26 countries were diagnosed with SARS, and 774 died.

To put those numbers in context, the CDC estimates that so far during the 2019-2020 influenza season, there have been at least 15 million flu illnesses, 140,000 hospitalizations and 8,200 deaths from flu.

Government Response

A bit of panic can motivate governments and public health authorities, which is a good thing, as it can lead to steps which can contain the outbreak.

The Communist Party has been limiting media coverage, but it does appear to be responding in a more transparent way than during SARS. On-line criticism of local officials in Wuhan—some of whom have acknowledged that they failed to act when initial Coronavirus cases appeared—has been permitted to an unusual extent. That may be just an attempt by national leaders to deflect blame for an overly centralized system, but opening avenues for public accountability is a positive development. After the initial stumble, the central government has taken strong measures, including quarantining several major cities, in an effort to reduce disease transmission and demonstrate resolve.

As for the rest of us, UC Riverside epidemiologist Brandon Brown, who has studied deadly disease outbreaks, told the LA Times, “Don't panic unless you're paid to panic. Public health workers should be on the lookout. The government should be ready to provide resources. Transmitting timely facts to the public is key. But for everyone else: Breathe.”

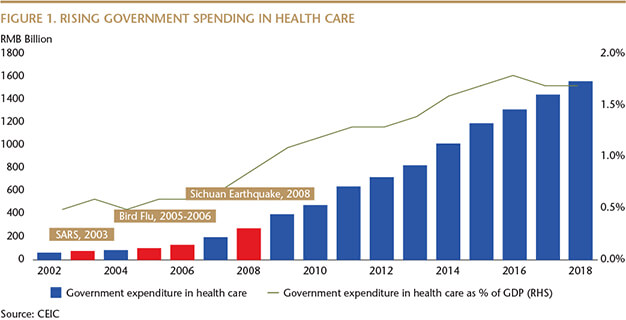

It is also worth noting that past epidemics, as well as the consequences of a major earthquake, led the Chinese government to boost spending on public health infrastructure, which should make it easier to manage the Wuhan outbreak.

Economic impact

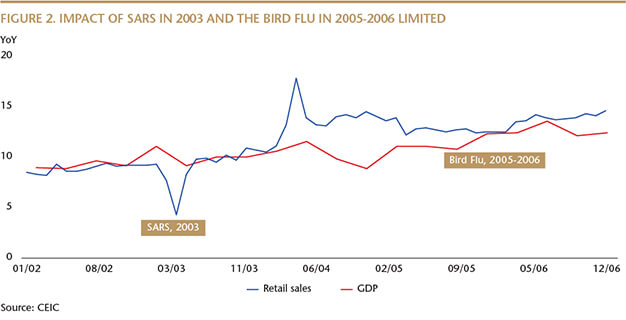

We've looked back at the economic impact of the 2002/03 SARS outbreak and the 2005/06 bird flu epidemic, and found that while there was significant short-term economic impact, that impact faded quickly. There also wasn't much impact on the Shanghai stock market.

During SARS, nominal retail sales growth slowed from 9.2% YoY in 1Q03 to 4.3% in May, but rebounded to 8.3% in June and was 9.8% in July and August. For the full year 2003, nominal retail sales were up 9.1% vs 8.8% in 2002.

GDP growth slowed from 11.1% YoY in 1Q03 to 9.1% in 2Q03, but rebounded to 10% in 3Q03. For the full year, GDP was up 10% vs 9.1% in 2002.

If the Wuhan Coronavirus can be brought under control in a similar timeframe as SARS was tamed, I expect the negative economic impact will be modest over the course of the full year.

Important information

The views and information discussed in this report are as of the date of publication, are subject to change and may not reflect current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. Investment involves risk. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Past performance is no guarantee of future results. The information contained herein has been derived from sources believed to be reliable and accurate at the time of compilation, but no representation or warranty (express or implied) is made as to the accuracy or completeness of any of this information. Matthews Asia and its affiliates do not accept any liability for losses either direct or consequential caused by the use of this information.