J.P. Morgan Asset Management - Testing the five big insights of our 2024 Outlook

With the year well underway, we welcome the opportunity to check in on the five considerations we put forth for investors looking to optimize their strategies for reaching financial needs and goals.

In our 2024 Outlook published at the start of December, we urged investors to consider the wide-reaching implications of the global interest rate reset. The shift to higher rates reconfigured the investment landscape in a way that requires careful contemplation of a set of possibilities, trade-offs and risks that were largely dormant over the previous decade.

With the year well underway, we welcome the opportunity to check in on the five considerations we put forth for investors looking to optimize their strategies for reaching financial needs and goals.

Inflation will likely settle. You should still consider hedging against it.

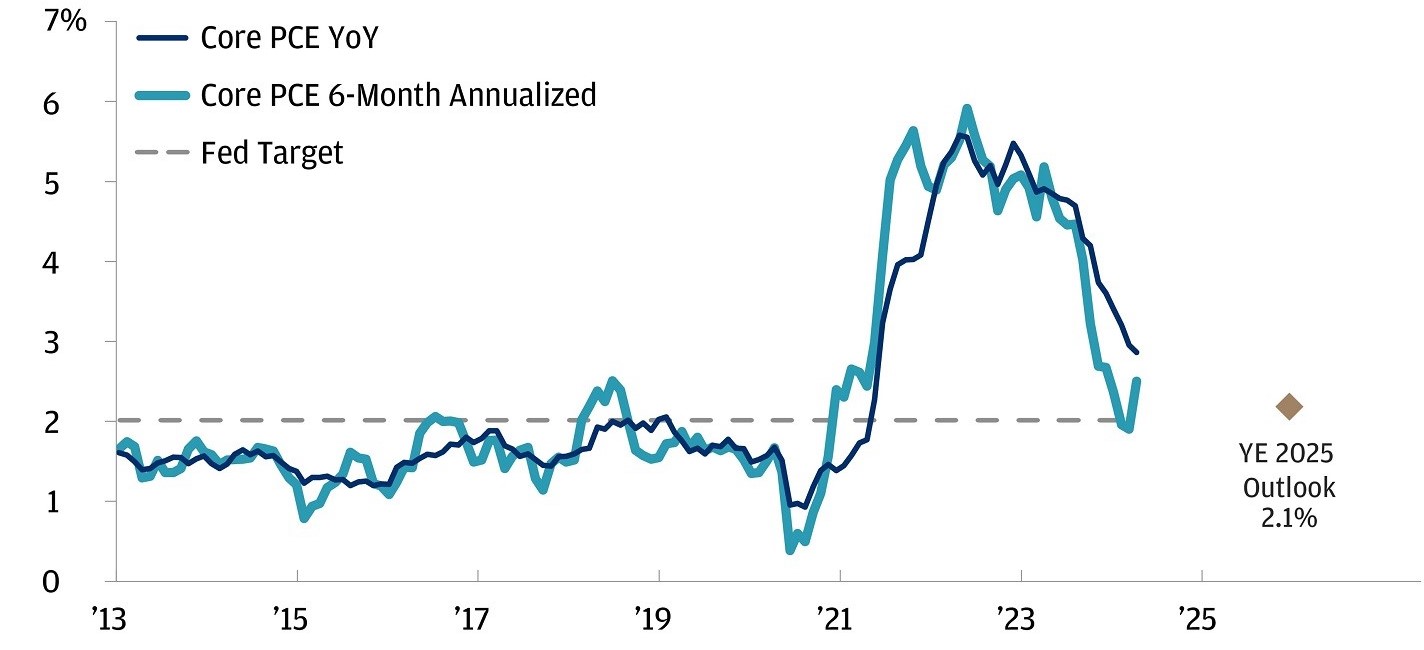

Although the Federal Reserve has made it clear that more data is needed to confirm that inflation has actually “settled,” the cooldown seen over the past year suggests progress is on track. Indeed, the Fed’s preferred price pressure gauge, core PCE (Personal Consumption Expenditures Deflator) showed that prices rose at a six-month annualized pace of 2.49% as of the end of January. That’s closing in on the Fed’s stated target of 2%. However, investors were reminded that the path to victory over inflation may be bumpy, as the Consumer Price Index (CPI), another popular gauge of inflation, came in with hotter-than-expected inflation in January. In all, we think the key drivers of the trend, such as abating wage pressures and a stabilization of real-time housing rental prices, remain intact.

PCE is already below the Fed's target

Core PCE, YOY & 6-month annualised %

Source: Haver Analytics. Data as of January 31, 2024

Beyond 2024, we continue to believe inflation could settle at higher levels than those experienced in the years leading up to the COVID-19 pandemic, on average. Breakeven rates and inflation swaps still imply this will be the case. We suggested that investors consider two asset classes as means of hedging against this dynamic: equities and real assets. The S&P 500 is set to mark its second consecutive quarter of earnings growth, and analyst earnings expectations show a steady ramp-up from here. Infrastructure, one of our preferred ways to implement real asset exposure, has maintained a consistent track record of generating total returns above annual rates of inflation throughout the post-global financial crisis era via a combination of income and capital appreciation. [1]

The cash conundrum: The benefits and risks of holding too much.

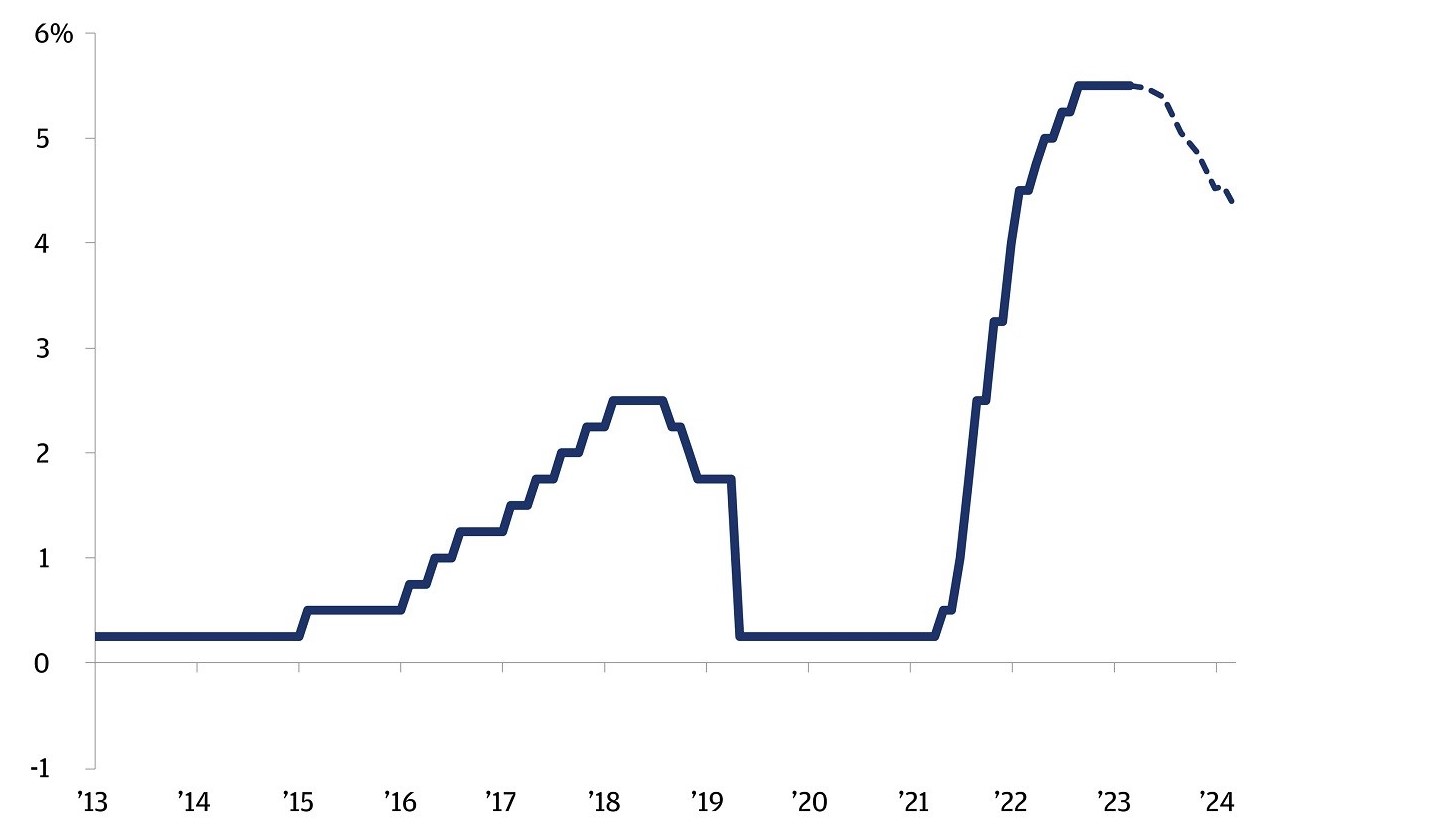

Global money market fund balances have continued to push higher year-to-date, having risen to over $6 trillion. It’s no wonder why: Cash yields are outpacing inflation and remain the highest they’ve been in over 20 years. But we’re keen to reiterate that current cash yields (proxied by three-month Treasury bills) are likely as good as they are going to get for the foreseeable future. As inflation trends lower, we, and central banks, are growing more confident that rate cuts are likely to come in 2024.

Rates are set to fall from here

U.S. federal funds rate & expectations

Source: Bloomberg Finance L.P. Data as of February 29, 2024

Our Outlook acknowledged that holding more cash in the present environment may not be a bad decision, but we maintain that it probably isn’t the most efficient means of making progress toward long-term financial goals. From the end of November (just before we published our Outlook) to now, a global benchmark 60/40 allocation has outperformed cash by more than 6%. [2] Over a 10-to-15-year investment horizon, J.P. Morgan Asset Management’s Long-Term Capital Market Assumptions projects global stock and bond annualized returns will outpace those of cash by 4.9 percentage points and 2.2 percentage points, respectively.

Bonds are more competitive with stocks – adjust the mix according to your ambitions.

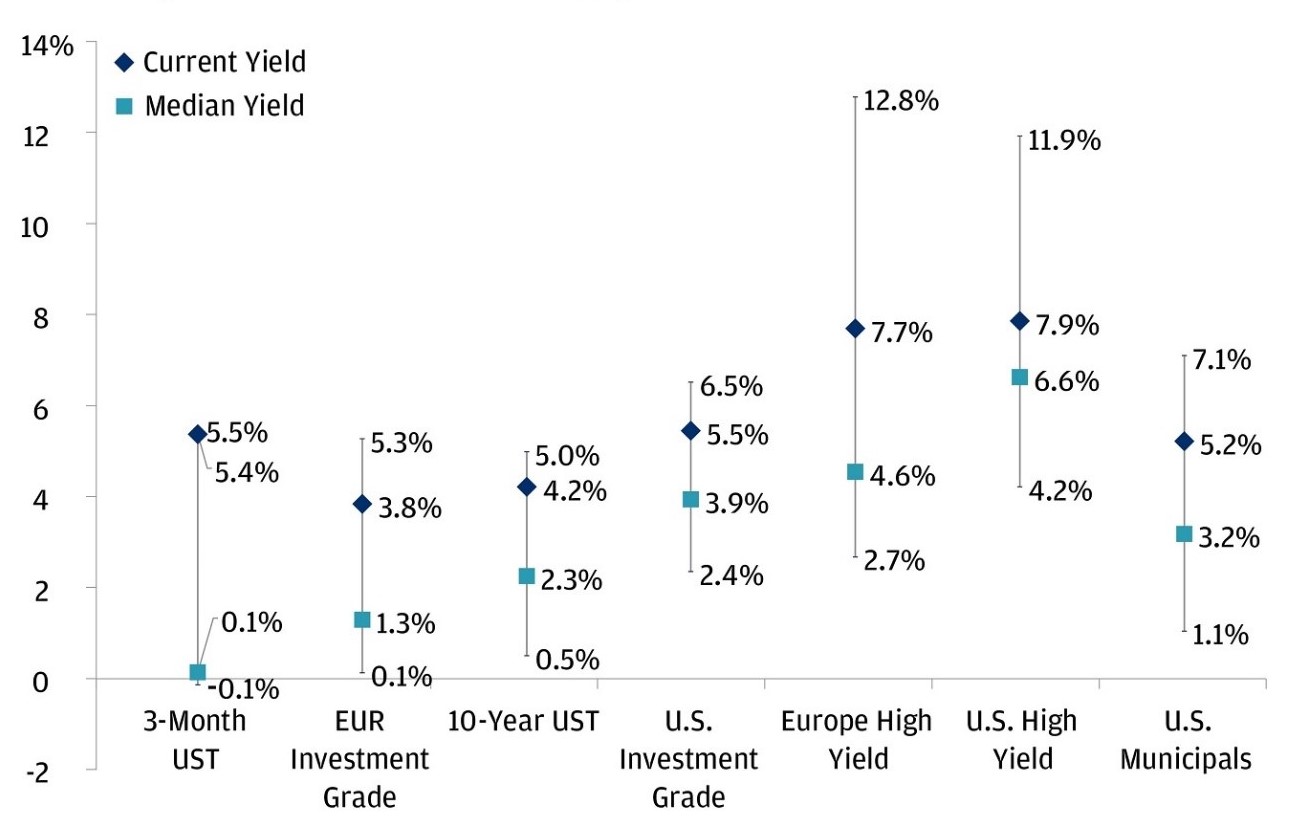

The interest rate reset revived the appeal of bonds, making them more competitive in relative asset allocation decisions. Absolute levels of yields are trading around where they were when we first published our 2024 Outlook, and their elevated levels continue to offer attractive asymmetrical return potential (i.e., all else equal, the potential gains that would be generated from a -100 basis point decline in yields are larger than the potential losses that would be generated from a +100 basis point rise).

Yields on high-quality bonds remain close to their highs

U.S. bond yields, current vs. 2010-2023 range, %

Source: Bloomberg Finance L.P. Data as of March 4, 2024

As the economic backdrop evolves and markets recalibrate expectations for the future path of central bank policy, our approach to the bond market has become modestly more nuanced. If you are focused on rightsizing your strategic portfolio allocations, we still believe now is the opportunity for considering locking in yields and capturing defensive characteristics by extending duration. That said, tight credit spreads and potential for more interest rate volatility could prompt more tactically focused investors to find better value on the shorter end of the duration spectrum (i.e., in the 2–3 year range).

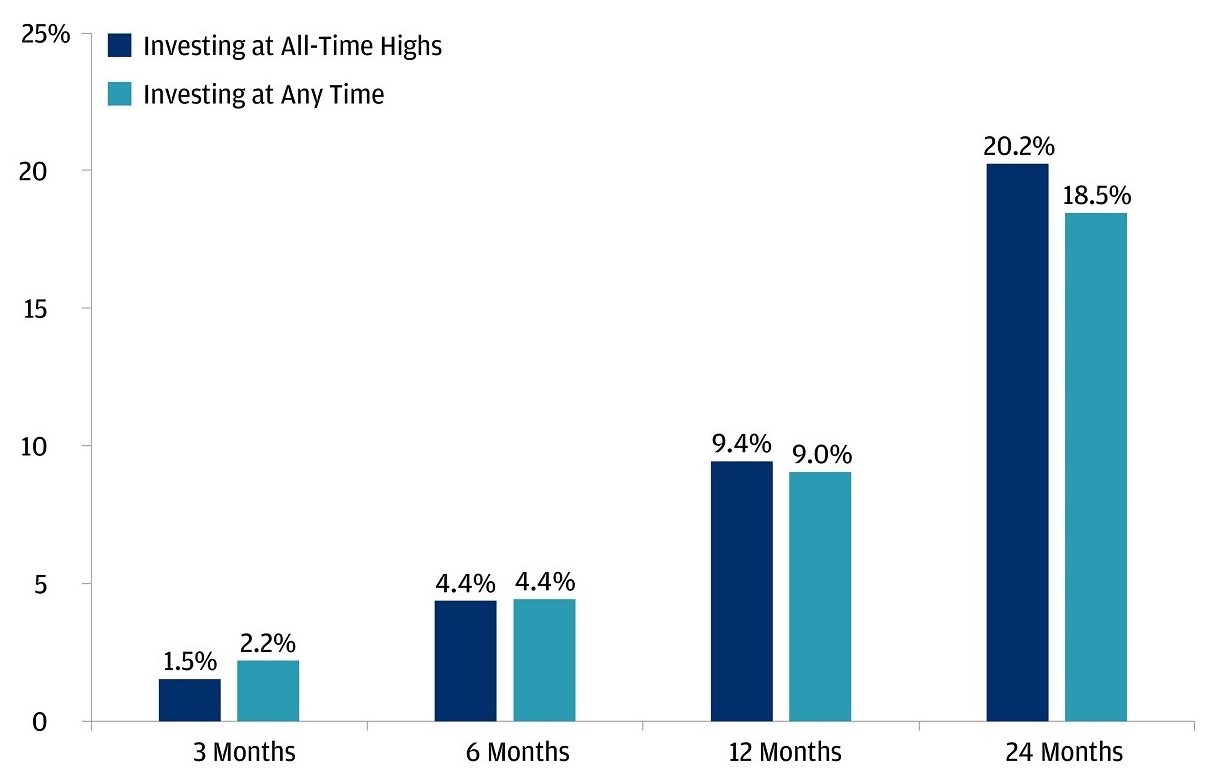

With AI momentum, equities have been marching to new highs.

The new highs came fast, with the S&P 500 notching a slew of fresh records already this year. We think the momentum can continue. Historically, new highs tend to cluster together, and forward-looking returns when investing at an all-time highs are not meaningfully different from returns when investing at any time. Going back to 1970, if you invested in an exchange-traded fund (ETF) or mutual fund that tracks the performance of the S&P 500 at an all-time high, your investment would have been higher a year later 70% of the time, with an average return of 9.4% versus a 9% average when investing at any time (at both records and non-records).

Investing at highs has not notably impacted returns

Average S&P 500 forward price return across tie periods, 1970-present, %

Source: Bloomberg Finance L.P., J.P. Morgan. Data

Artificial intelligence (AI) enthusiasm has played a big part, propelling the so-called Magnificent 7 higher and pushing market concentration to its most extreme since the early 1970s. But it’s not without good reason, and it’s not all hype: Stellar earnings have underpinned the enthusiasm, and valuations actually look reasonable when factoring in expectations for more strong growth ahead.

From here, we think the rally has more room to run. Big tech can continue to climb, and other sectors can join in. For instance, we see the potential for themes such as health care innovation and ongoing consumer resilience to support recoveries in some areas going forward.

Pockets of credit stress loom, but they will likely be limited.

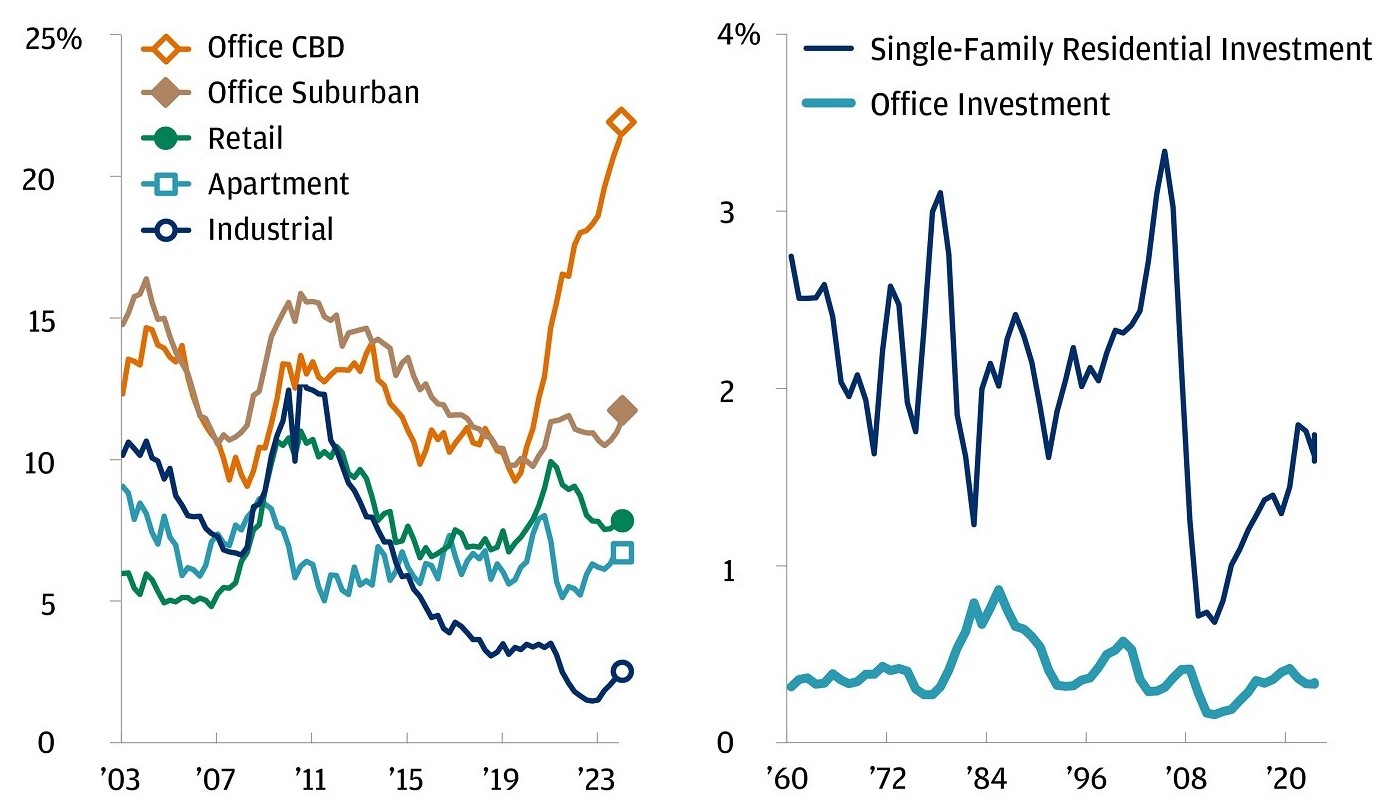

At the end of January, investors got another stark reminder that the ripple effects of last year’s bout of bank stress aren’t fully past. In its Q4 earnings update, New York Community Bank Corp (NYCB) – a U.S. regional bank that had bought part of failed Signature Bank last year – flagged expectations of losses on commercial real estate (CRE) loans and cut its dividend. As we’ve learned, commercial real estate (especially the office sector) is more vulnerable to both the lagged impact of higher rates and pandemic-era shifts in the way that people live and work. Stress in this pocket of the economy is likely to continue.

This doesn’t change our Outlook, and we still expect the impact on the broader economy to be limited. Office makes up just 2.4% of all physical assets across the U.S. economy. [3] Many of NYCB’s challenges, especially around additional reserve builds going into CRE, also look company-specific, rather than indicative of the broader sector. That’s been reflected in the stock performance: While shares of NYCB plummeted 55% in the two weeks after its earnings report, a measure of broader regional banks fell “just” 11%, and the S&P 500 rallied almost 1%.

Moreover, as much as much as CRE is a risk, it can also provide opportunity for experienced active managers. The Fed’s pivot toward cutting won’t solve all problems: The rate hikes we’ve already seen will continue to have an effect, especially in overleveraged pockets of the market. Private lenders can collect a premium for providing capital, and stress-focused managers can take advantage of mispriced assets and loans.

Remote work has disrupted office occupancy

U.S. CRE vacancy rate, SA %

Source: (LHS) NCREIF, J.P. Morgan. Data as of December 31, 2023. (RHS) BAML Chartbook. Data as of December 31, 2023.

We still see opportunity ahead.

We echo what we said back in December: There haven’t been this many attractive investment choices to consider in more than a decade.

Cash may still look alluring, but the allure is fading as central banks turn to rate cuts, pending adequate data. Bond yields are high, presenting opportunities across the curve. Equity valuations seem fair, especially when considering accelerating earnings growth ahead. Private markets can continue to offer premiums over their public counterparts, while also becoming more accessible to investors. [4]

References

[1] J.P. Morgan Asset Management Guide to Alternatives, J.P. Morgan Asset Management 2024 Long-Term Capital Market Assumptions, MSCI. As of December 31, 2023.

[2] Bloomberg Finance L.P. Benchmark 60/40 portfolio references the Bloomberg Global EQ:FI 60:40 Index, which rebalances monthly to 60% Bloomberg Developed Markets Large & Mid Cap Total Return Index and 40% Bloomberg Global Aggregate Index. Cash performance references the total return on the Bloomberg US Treasury Bill: 1-3 Months Index. As of February 29 2024. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

[3] World Bank, Bureau of Economic Analysis, Bloomberg Finance L.P., Haver Analytics. Data as of 2023.

[4] J.P. Morgan Asset Management Long-Term Capital Market Assumptions. As of December 31, 2023.

Important Information:

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

May 2024

Please note that these are the views of J.P. Morgan Asset Management and should not be interpreted as the views of RL360.