Pictet Asset Management - Emerging markets in the new world order

The world order of the second half of the 20th century is being turned on its head. The shift should be positive for emerging markets and thus investors in EM debt.

Table of contents

- Advantage, emerging markets

- Shaping the global economy

- Next-gen EM

- Adding geopolitics to the mix

- Opportunities ahead

01. Advantage, emerging markets

A new world order is taking shape and it promises to be a boon for investors in emerging market bonds. The structural shift is in part due to changes in geopolitics, and in part down to the maturing of emerging economies. For one thing, many emerging nations have evolved to a point where they can step up to the next level of development. Meanwhile, political changes within developed countries are also to emerging markets' advantage.

The first of these transformative forces is the persistence of the post-Berlin Wall effect: Eastern Europe opened to trade and China rose as a market economy, triggering a boom in globalisation. Notwithstanding gloom mongers, globalisation isn’t over. But now that China has replaced the Soviet Union as the global counterweight to the US-led West, new geopolitical risks are surfacing, and they look increasingly like the old Cold War ones.

Within this, there’s an enhanced role for emerging markets. China’s strained relationship with the West, including the imposition of trade tariffs, means that it will increasingly look to other emerging economies as a source of demand for its goods. And with Western capital flows into China likely to slow for those same reasons, this will free capital up to flow into the wider emerging universe.

EM economies are particularly interesting for foreign investors because of their abundance of resources – in terms of both raw materials and human capital.

At the same time, economic policy in developed markets is undergoing a major transition. During recent decades, governments deferred to their central banks to stimulate growth, while primacy was given to targeting inflation, which imposed significant constraints on fiscal spending. Post-Covid this has been turned on its head. Government spending is the key policy tool, with central banks’ role now as a stabilising force for the economy. How governments fund the resulting deficits will affect investment flows and, therefore, what happens to their currencies. Given the US’s massive twin deficit – current account and government balance – and its reliance on foreign capital, over time the dollar will come under pressure. This has far-reaching positive spill-over effects for emerging market economies and assets.

02. Shaping the global economy

Developed markets will be the primary drivers for how this new world order develops. Expansionary fiscal policy across advanced economies will put paid to the secular stagnation that set in following the global financial crisis. Incentives for governments to spend are wide ranging. Some originate domestically, with growing pressures to meet social demands, while others stem from the need to compete internationally – addressing China’s rise through spending on strategic areas like military infrastructure and industrial policy. But debt burdens are becoming an increasing constraint, exacerbated by the cost of servicing that debt in a world of higher interest rates.

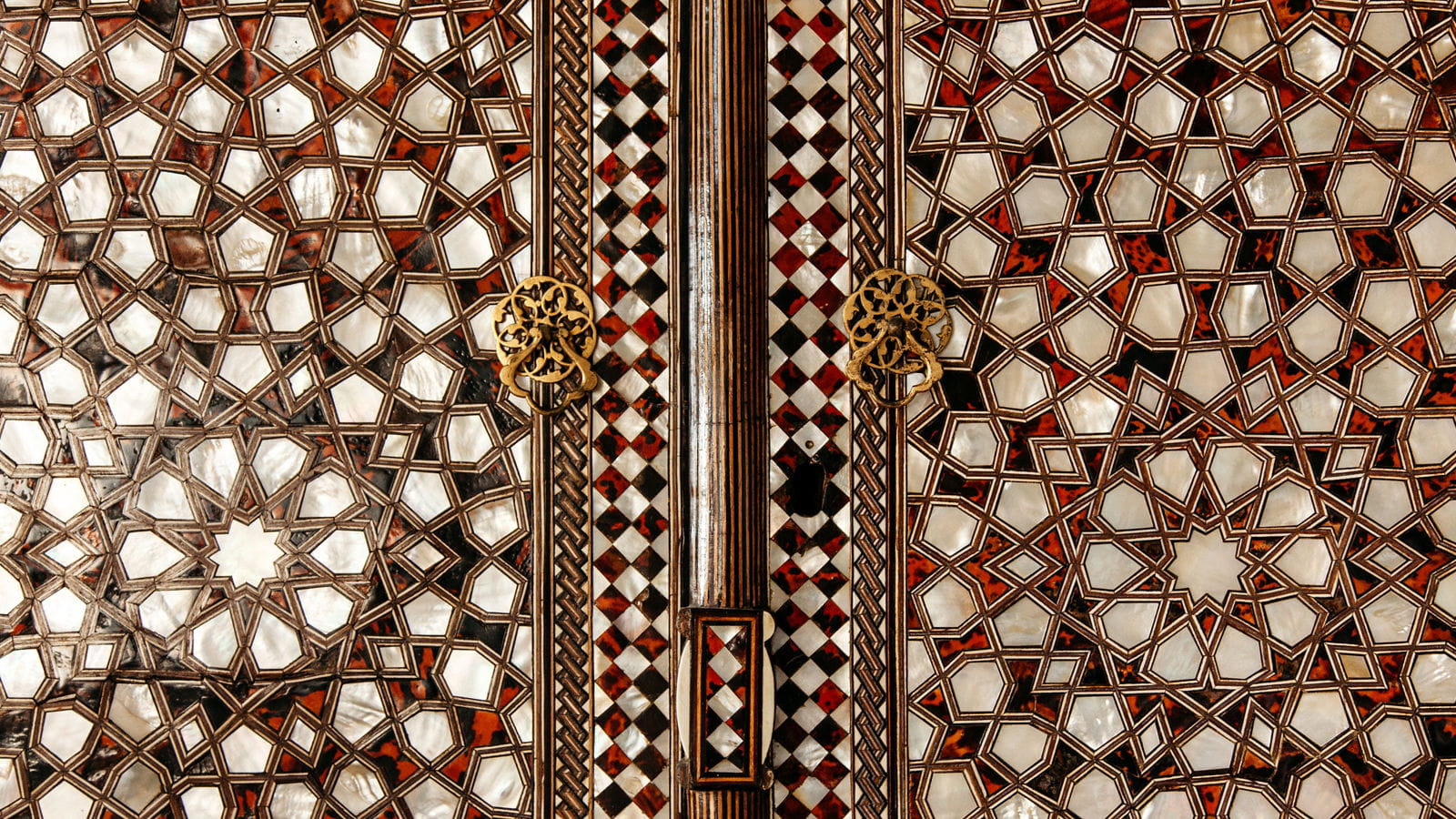

Fig. 1 - Repatriation potential

Japanese foreign portfolio investment (USD bn; % of total)

Source: IMF. Data covering period 31.12.2001 to 31.12.2022.

The result of this sea-change is that governments are unlikely to return to austerity – at least not until they’re forced to do so by the markets. Instead, governments will try to keep their debt burdens in check by growing their economies. Increased but targeted government spending will drive higher capital expenditure and demand for resources – both of which are likely to benefit commodity producers. The downside is that higher interest rates will predominate.

What’s less clear is how this fiscal largesse will affect international capital flows. Highly indebted governments will adopt a new style of financial repression. They will seek to unlock domestic capital – much of which is currently invested abroad, disproportionately in the US – via tax incentives, legislation and marketing (see Fig. 1). This could well prompt a reversal of the money flows that have until now underpinned US asset price outperformance and, ultimately, US dollar strength. Should this occur, it would ultimately be most transformative for asset prices in emerging markets – developing economies stand to benefit from the combination of resurgent investment and capital spending.

03. Next-gen EM

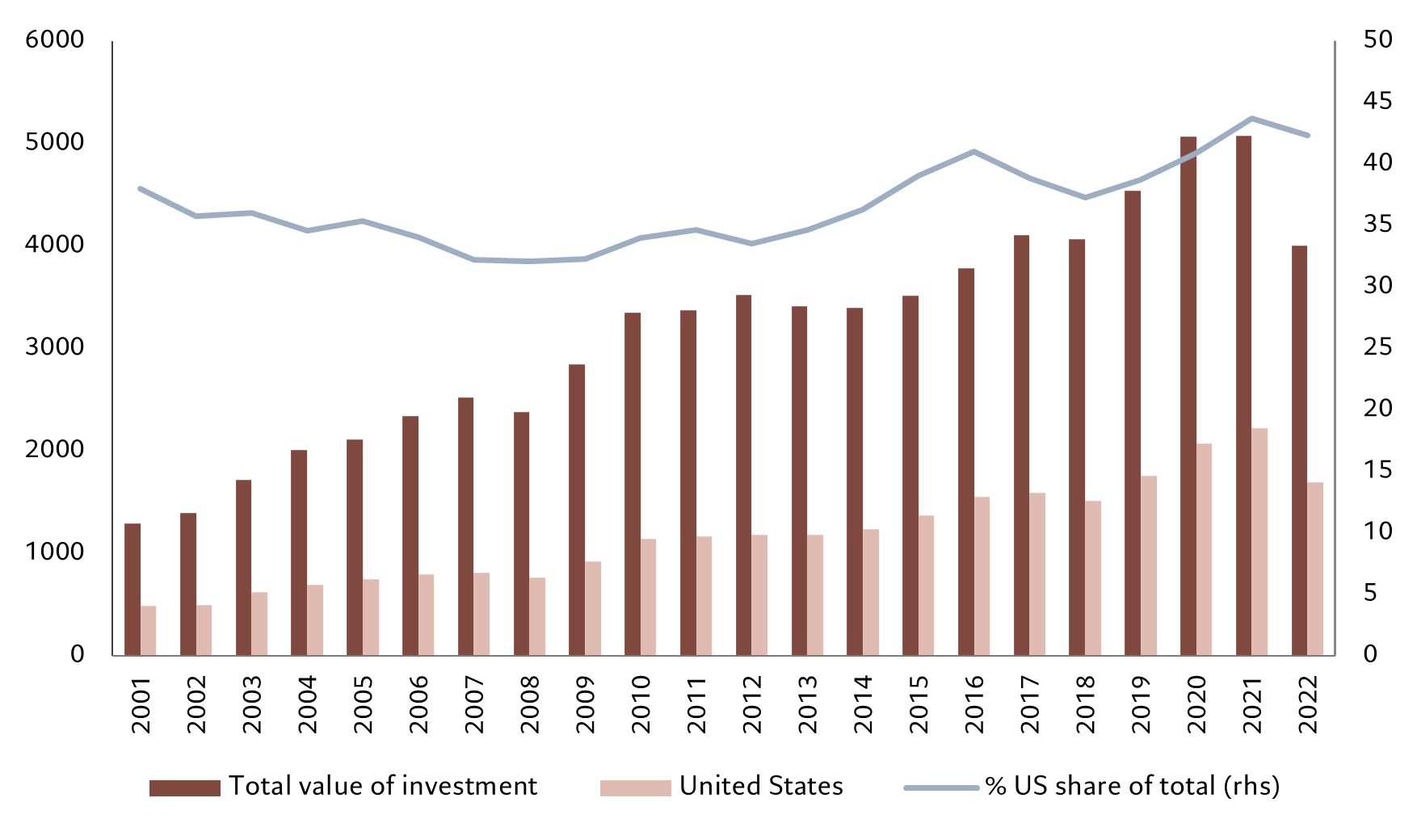

oday’s emerging markets aren’t those of yesterday. These economies are typically much more mature and well ordered. They are less likely to experience turmoil on the scale of the Latin American debt crisis, the Asian crisis, or the Russian debt crisis. In fact, in some respects they look considerably more responsible than developed market economies. Take debt. While debt-to-GDP ratios in developed markets have jumped from 70 per cent in 2000 to 126 per cent now, in emerging economies that ratio has only risen from 47 per cent to 68 per cent, and if one excludes China, from 52 per cent to 57 per cent (see Fig. 2).

Fig. 2 - Prudent EM

Emerging markets vs G7 government debt to GDP ratios and share of debt issued externally (%)

Source: Pictet Asset Management, Bloomberg, IMF. Data covering period 31.12.2000 to 31.12.2023.

Not only that, but they are now less vulnerable to investor flight. In 2008, 81 per cent of emerging market sovereign debt was issued externally in foreign currency, predominantly dollars. By 2023 that proportion had dropped to 44 per cent. The majority of emerging market sovereign debt is now financed domestically, in local currency.

That’s down to the increasing maturity of these economies – there are more domestic savers who now have increasingly sophisticated domestic capital markets in which to invest their money. This maturity is, in turn, a product of economic growth and the discipline imposed on governments by independent central banks, by floating exchange rate regimes, by fiscal rules, by the creation of public and private pension systems and by ever more solid domestic institutions. This is particularly true in countries that in the past had been prone to crises.

04. Adding geopolitics to the mix

During recent decades, China has primarily been seen as a source of cheap goods. Now it’s also seen as a serious centre of power – a counterweight to the West that hasn’t existed since the destruction of the Soviet empire. That’s causing strains. But it also creates opportunities.

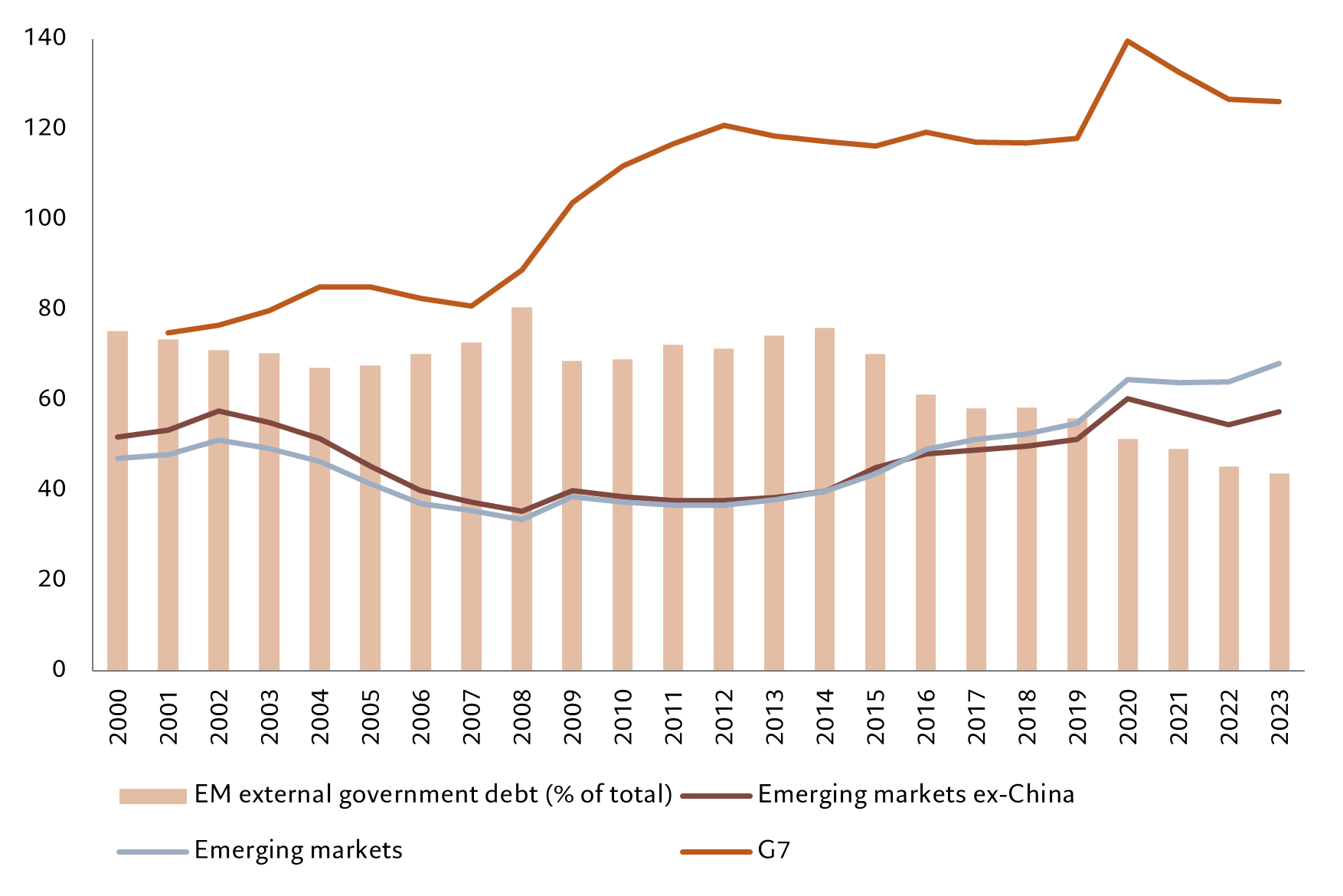

Fig. 3 - Less crowding out

China foreign direct investment (% of GDP)

Source: Pictet Asset Management, CEIC, Refinitiv. Data covering period 01.01.1982 to 31.12.2023.

The pandemic forced Western governments to recognise how much of their supply chains were tied to China. That coincided with a realisation of how powerful China had become militarily as well as economically. The drive by developed countries to reduce their dependence on the country was a blessing to other emerging economies. Some, like Latin America, have benefited from US near-shoring. At the same time, Chinese firms have shifted some of their own production abroad, particularly to South-East Asia, as a way of circumventing some of the trade barriers that have sprung up.

This has boosted capital flows to the rest of EM Asia, not just because investment is no longer being crowded out by the capital-hungry regional giant, but also because increasingly rapid growth in these countries has created a deeper and broader middle class who are looking for places to put their savings (see Fig. 3).

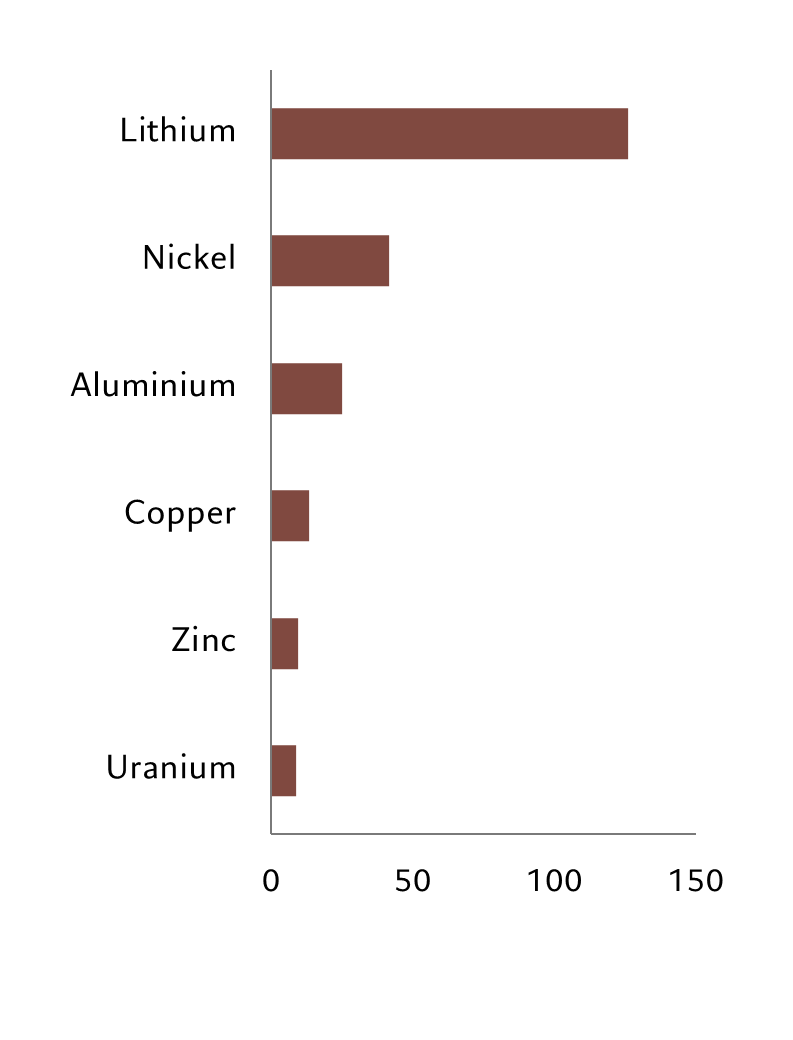

Many of these countries are resource rich – they are the main source of metals needed for the clean energy transition as well as strategic minerals for military and technical applications. And demand is only set to grow for these (see Fig. 4).

Fig. 4 - Pedal to the metal

Estimated commodity demand growth (% change 2023-2029)

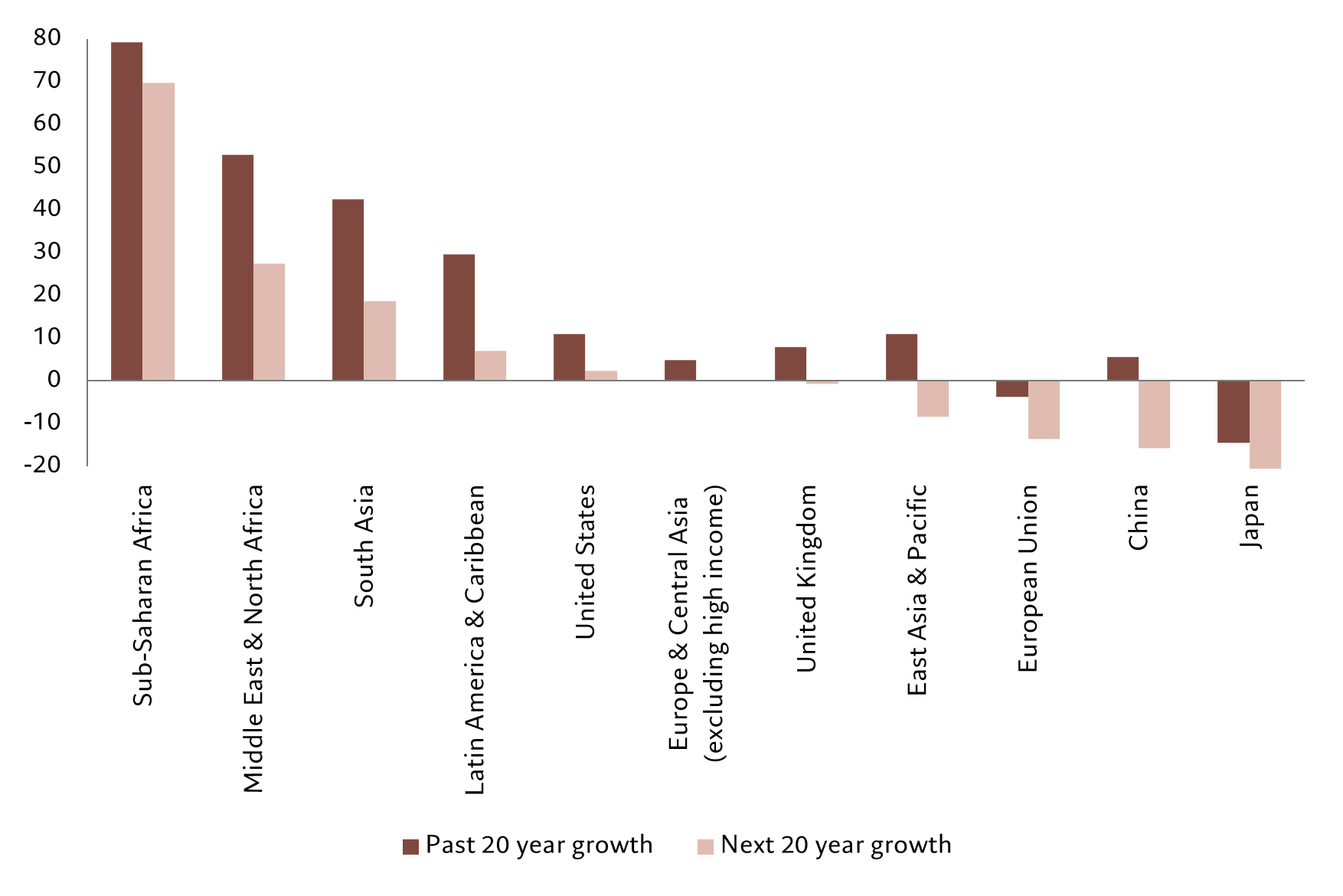

Perhaps their most important resource, however, isn’t mined or felled – it’s their people. Many developed countries face ageing and shrinking populations. That’s less of an issue in the emerging world – albeit with some notable exceptions like South Korea and China (see Fig. 5). This isn’t just cheap labour, but it represents the future of consumption and of innovation as greater wealth feeds through to education. Foreign firms have discovered this resource: Google, for instance, doesn’t see India as a place to outsource low skilled jobs, but is hiring across the pay spectrum, with a view to building services to meet local needs. [1]

For emerging economies to fully take advantage of capital flows, their infrastructure needs to be built out – something their governments are encouraging. Development banks are competing to invest in emerging markets – for instance, the IMF in Latin America, World Bank and US Treasury in West Africa, while Middle Eastern sovereign wealth funds are also being increasingly active. Collectively, these are helping to fund investment while also providing an important backstop to sovereign credit markets and thus reducing default risk.

Source: Australian Government "Resources and Energy Quarterly."

[1] https://www.cnbc.com/2024/05/01/google-cuts-hundreds-of-core-workers-moves-jobs-to-india-mexico.html

Fig. 5 - Human capital opportunities

Working age population growth, past 20 years and next 20 years (ages 15-64, % change)

Source: Pictet Asset Management, World Bank Data Bank: "Population estimates and projections".

05. Opportunities ahead

These long-run trends will play out over multiple phases. At some stages, investors will be rewarded for taking on greater exposure to emerging market sovereign and corporate credit. Other phases will favour extending duration. In yet others, outperformance will derive from investing more heavily in emerging market local currency bonds and currencies.

In any case, the fundamentals for emerging market bonds are attractive on several fronts.

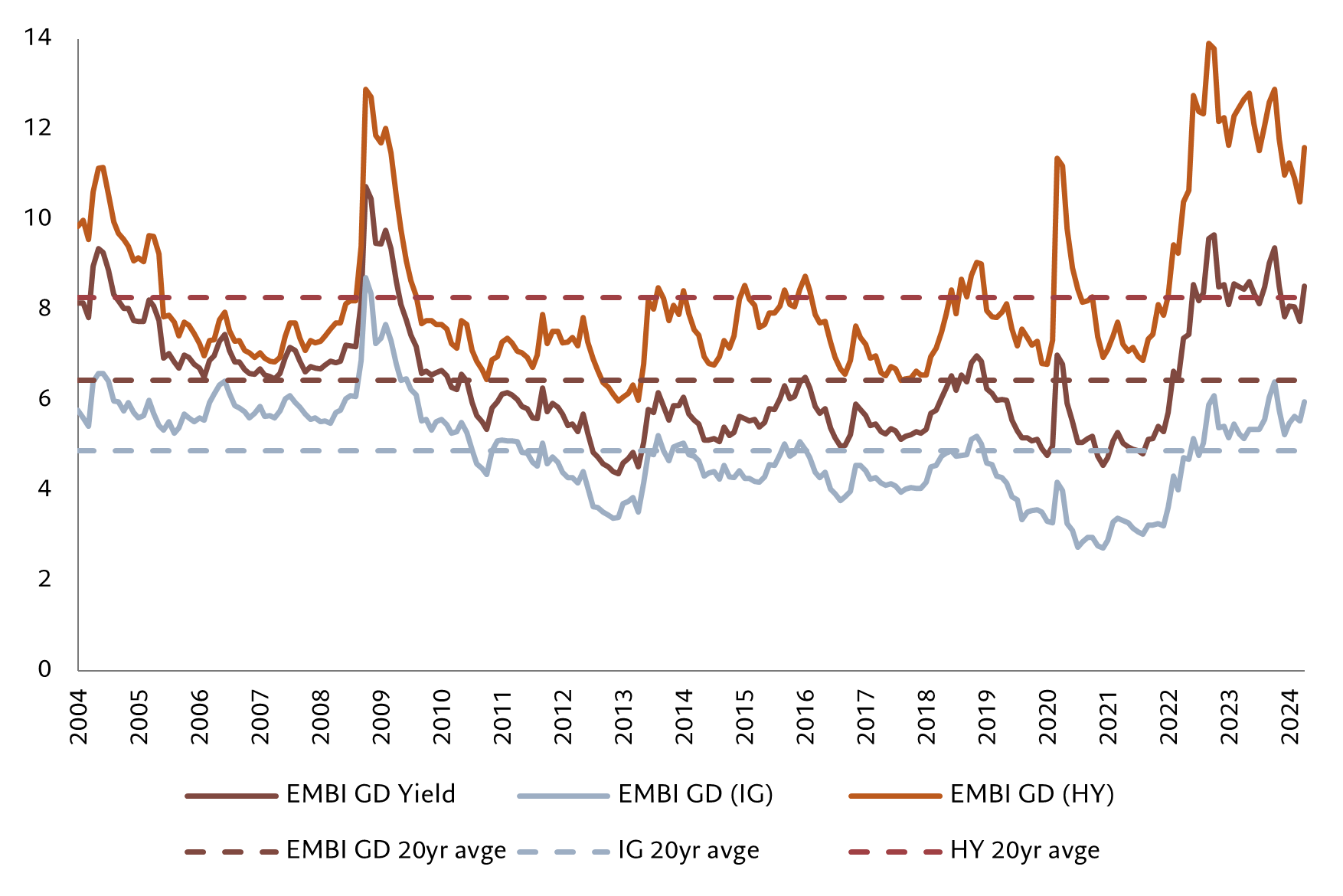

To begin with yields are high, in large part because the yield on the world’s “risk-free” asset of choice, 10-year US Treasury bonds, is high. That’s likely to come down as US inflation comes down and the US Federal Reserve starts to ease monetary policy. These elevated yields offer an attractive entry point for investors.

Fig. 6 - Above average

EMBI GD index yields, including investment grade and high yield vs their 20-year averages (yield to maturity %)

Source: Pictet Asset Management, JP Morgan Index Research, Bloomberg. Data covering period 30.01.2004 to 30.04.2024.

At the same time, low foreign ownership of emerging market debt, particularly local currency debt, plus the fact that these currencies are significantly undervalued offers investors a good balance of reward for given risk.

And emerging market bonds are an effective diversifier for portfolios. Emerging market fixed income exhibits low correlations to core fixed income asset classes – US treasury bonds and investment grade credit – but is also uncorrelated to US equities. At the same time, the sub-asset classes within emerging market bonds – hard currency sovereign, hard currency credit, local currency sovereign, local currency credit – are also relatively uncorrelated with each other, creating opportunities for diversification within an emerging market fixed income allocation.

Together, these factors offer investors an expanded opportunity set. Local currency debt, both sovereign and corporate, looks increasingly attractive thanks to the strong domestic investor bases. More generally, sovereign and corporate credit risk is reduced, particularly in the case of large, systemic countries and companies. This reduced reliance on the dollar, makes these assets less sensitive to US interest rates and less sensitive to external shocks. But crucial to navigating this new world order will be the ability to dynamically allocate across the whole range of emerging market assets.

Important Information

This article is used for informational purposes only and does not constitute,on Pictet Asset Management part, an offer to buy or sell solicitation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. The effective evolution of the economic variables and values of the financial markets could be significantly different from the indications communicated in this document.

July 2024

Please note that these are the views of Pictet Asset Management and should not be interpreted as the views of RL360.