Schroders - Scared of investing when the stock market is at an all-time high? You shouldn’t be

Is it a good idea to invest when the market is at an all-time high? Be led by the data: read our analysis of 100 years’ returns.

After crashing hard in April, the US stock market rebounded even harder, recently hitting a new all-time high. This has left many investors feeling nervous about the potential for a fall.

Many others have parked savings in cash, attracted by the high rates on offer. The thought of investing that cash-on-the-sidelines when the stock market is at an all-time high feels uncomfortable. But should it?

The conclusion from our analysis of stock market returns since 1926 is unequivocal: no.

The market is actually at an all-time high more often than you might think. Of the 1,187 months since January 1926, the market was at an all-time high in 363 of them, 31% of the time.

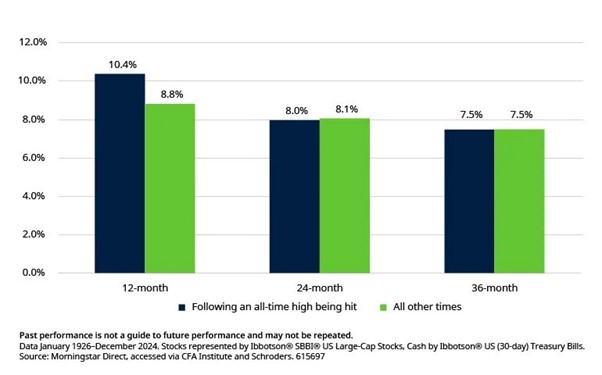

And, on average, 12-month returns following an all-time high being hit have been better than at other times: 10.4% ahead of inflation compared with 8.8% when the market wasn’t at a high. Returns on a two or three-year horizon have been similar regardless of whether the market was at an all-time high or not (see chart below).

Returns have been higher if you invested when the stock market was at an all-time high than when it wasn’t

Average inflation-adjusted returns for US large cap equities, p.a.

Differences compound over time

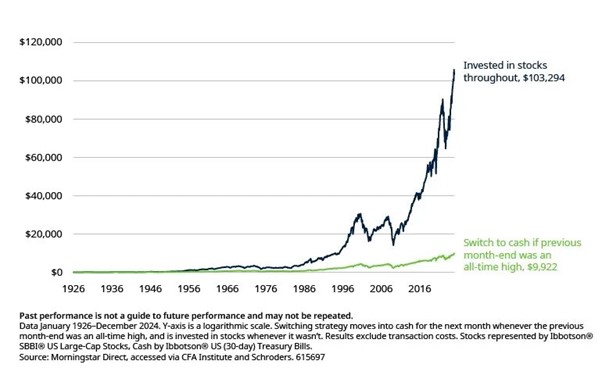

$100 invested in the US stock market in January 1926 would be worth $103,294 at the end of 2024 in inflation-adjusted terms, growth of 7.3% a year. In contrast, a strategy which switched out of the market and into cash for the next month whenever the market hit an all-time high (and went back in again whenever it wasn’t at one) would only be worth $9,922 (Figure 2). This is 90% lower! The return on this portfolio would have been 4.8% in inflation-adjusted terms. Over long time horizons, differences in returns can seriously add up.

Selling stocks whenever the market was at an all-time high would have destroyed 90% of your wealth in the very long-run

Growth of $100, inflation-adjusted terms

This analysis covers a nearly 100-year time horizon, longer than most people plan for. But, even over shorter horizons, investors would have missed out on a lot of potential wealth if they had taken fright whenever the market was riding high (Figure 3).

Selling stocks whenever the market was at an all-time high would have destroyed 90% of your wealth in the very long-run

Growth of $100, inflation-adjusted terms

| Growth of $100 invested x years ago | Invested in stocks throughout | Switch to cash is previous month-end was an all-time high | Wealth destroyed by switching |

| 10 years | 255 | 185 | -27% |

| 20 years | 433 | 268 | -38% |

| 30 years | 1,064 | 449 | -58% |

| 50 years | 5,627 | 2,035 | -64% |

| Since 1926 | 103,294 | 9,922 | -90% |

Past performance is not a guide to future performance and may not be repeated.

Data January 1926-December 2024. Y-axis is a logarithmic scale. Switching strategy moves into cash for the next month whenever the previous month-end was an all-time high, and is invested in stocks whenever it wasn’t. Results exclude transaction costs. Stocks represented by Ibbotson® SBBI® US Large-Cap Stocks, Cash by Ibbotson® US (30-day) Treasury Bills. Source: Morningstar Direct, accessed via CFA Institute and Schroders.

Conclusion? Don’t fret over all-time highs

It is normal to feel nervous about investing when the stock market is at an all-time high, but history suggests that giving in to that feeling would have been very damaging for your wealth. There may be valid reasons for you to dislike stocks. But the market being at an all-time high should not be one of them.

Important Information

Any reference to regions, countries, sectors, stocks or securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy. Past performance is not a guide to future performance and may not be repeated.

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.

September 2025

Please note that these are the views of Schroders and should not be interpreted as the views of RL360.