Excluded Property Trust

The excluded property trust is suitable for:

- UK resident and non-resident individuals who are not UK domiciled or deemed domiciled in the UK for UK inheritance tax (IHT) purposes.

The excluded property trust is not suitable for individuals who are born in the UK with a UK domicile of origin at birth and are now UK tax resident.

Example

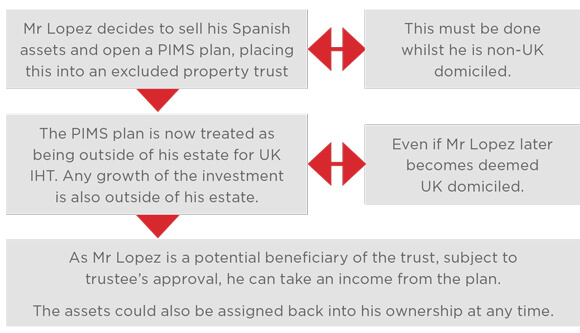

- Mr Lopez is resident in the UAE and is a non-UK domiciled individual. He was born outside of the UK.

- He holds Spanish investments that are currently valued at £400,000.

- He is relocating to the UK to take up employment.

- Mr Lopez is concerned about UK (IHT) exposure on his non-UK assets upon his death.

While Mr Lopez remains non?UK domiciled he will only be taxed on his UK assets.

Where Mr Lopez has been UK resident for at least 15 of the last 20 tax years he will then be treated as deemed UK domiciled for all tax purposes, and taxed on his worldwide assets from the sixteenth year.

Solution

The table below provides a comparison of the IHT situation should the Spanish assets be placed into an excluded property trust verses no excluded property being used, therefore taxed as part of his worldwide assets. By the time of Mr Lopez’s death, the value of assets has grown to £590,000.

| Excluded Property Trust | No Excluded Property Trust | |

|---|---|---|

| Value of assets | £590,000 | £590,000 |

| Nil Rate Band | n/a | £325,000 |

| IHT at 40% | £0 | £265,000 |

| IHT to pay | £0 | £106,000 |

Important notes

Please note that every care has been taken to ensure that the information provided is correct and in accordance with our current understanding of the UK law and HM Revenue and Customs (HMRC) practice as at April 2021. You should note however, that we cannot take on the role of an individual taxation adviser and independent confirmation should be obtained before acting or refraining from acting upon the information given. The law and HMRC practice are subject to change.